multistate tax commission form

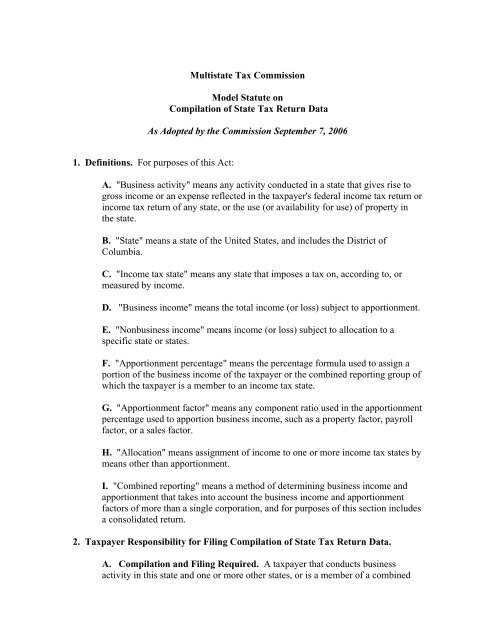

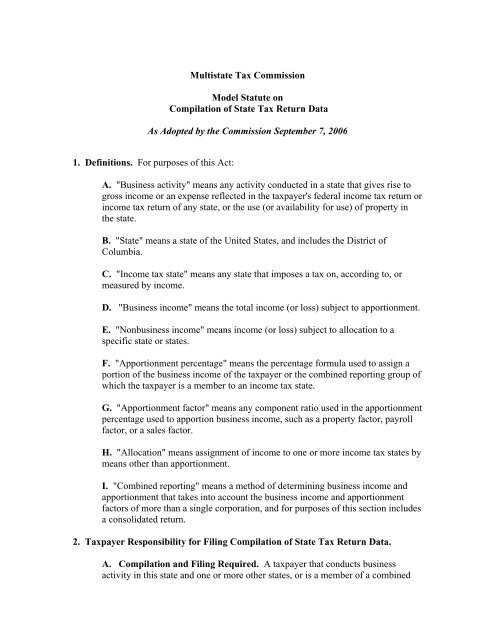

Business Credits Form 20C-C. Add-Back Form Schedule BC.

Multistate Tax Commission News

Round up to the next dollar if an amount is more than 50 cents.

. This form contains the same information as the prior form. Alabama Consolidated Corporate Income. Forms Search Most Popular Forms Form 20C.

Form 1099-NEC Nonemployee Compensation. Log into your TAP. A description of the property to be purchase.

Get Your Max Refund Today. Alabama Corporate Income Tax Return Schedule AB. The purchasers sellers permit number unless they are not required to hold one 1.

The certificate may be in any form so long as it contains. For purchases by government Native American tribes and public schools use form TC-721G. In Lieu of Alabama Form 99 and Form 96 please submit a copy of the Federal Form 10961099.

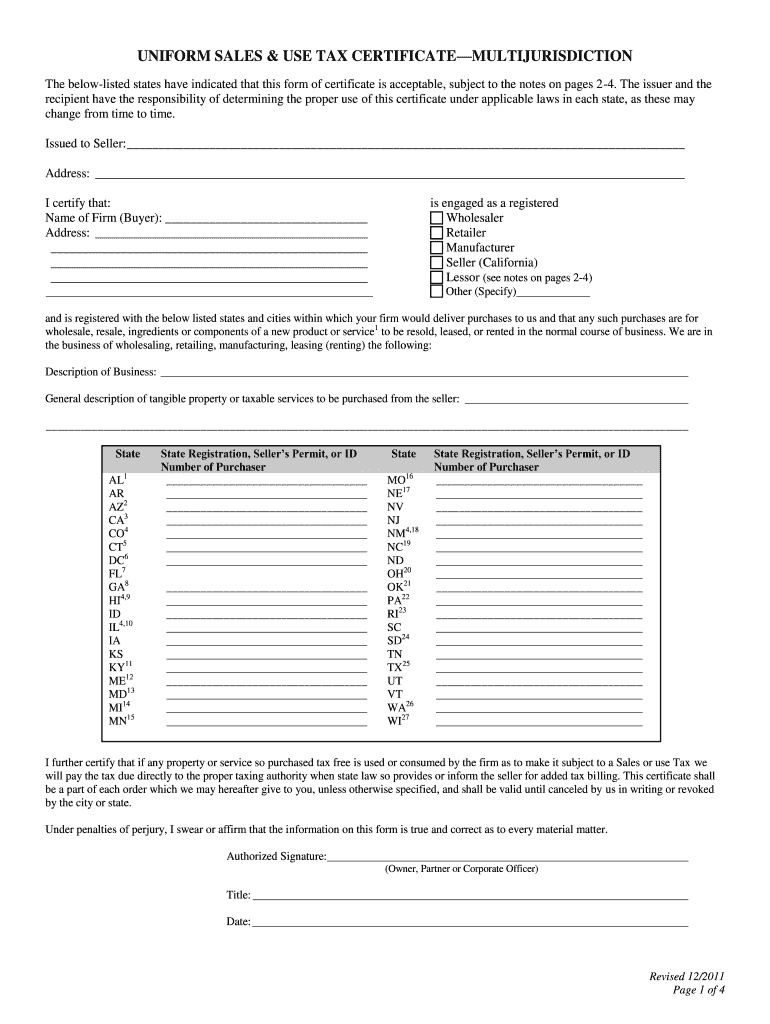

The correct amount of tax to ensure you are complying with the tax laws and to exchange tax information with the Internal Revenue Service other states and the Multistate Tax Commission Chapter 32. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. The MTC site makes clear that they are not guaranteeing that this form is still accepted by any of the states States listed on the certificate accepted this certificate as of July 2000.

If you have no withholding to report you must file a zero Form 910 either electronically or through the mail but not both. You must have an Idaho withholding account if you have an employee earning income while in Idaho. Filing Form 910 Filing Form 967.

The Streamlined Exemption Certificate and instructions are accepted by all 24 Streamlined member states. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Round amounts to the nearest dollar when filing Form 910 or Form 967.

Everyone has legal documents such as a drivers license voters card federal income tax return military form no. If a nurse cannot declare a compact state as hisher PSOR that nurse is not eligible for a compact license. DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION Keep it with your records in case of an audit.

In addition statutorily provided non-tax. The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate. Instructions for purchasers and sellers are on the back side of this form.

Please see mailing link below. Most states will release updated tax forms between January and April. 2058 or W2 form from the primary state of residence PSOR.

Drop shippers and sellers that have products. Resale or Re-lease I certify I am a dealer in tangible personal property or services that are for resale or re-lease. The current tax year is 2021 with tax returns due in April 2022.

The state of Kansas. States may change their policies for acceptance of the certificate without notifying the Multistate Tax Commission. Idaho has a state income tax that ranges between 1125 and 6925.

You do not need to update the forms you have on file but should use this form going forward. Forms To view a complete listing of forms for corporations please visit the forms page. Each party State and subdivision thereof may make the same election available to.

If a nurses PSOR is a compact state that nurse may be eligible for a multistate compact license. The Certificate itself contains instructions on its use lists the States that have indicated to the Commission that a properly filled out form satisfies. The name and address of the purchaser.

You may search by form number title of the form division tax category andor year. This form is new for 2020. You may check with the relevant state.

Forms Guides and Tables This guide explains income tax withholding requirements for employers. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. If I use or consume any tangible personal property or services I purchase.

No Matter What Your Tax Situation Is TurboTax Has You Covered. This applies to all employees including agricultural. This multijurisdiction form has been updated as of January 20 2022.

Per Act 2017-294 Payment Settlement Entities PSE are now required to file Form 1099-K with the Alabama Department of Revenue for payees with an Alabama address. The certificate may be in any form but a blank resale certificate is available online. File Form 910 for every filing period eg monthly quarterly.

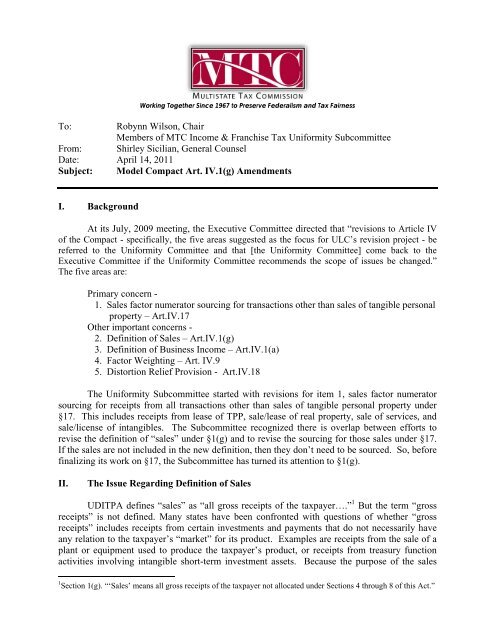

The Multistate Tax Commission not more than once in five years may adjust the 100000 figure in order to reflect such changes as may occur in the real value of the dollar and such adjusted figure upon adoption by the Commission shall replace the 100000 figure specifically provided herein. Filing Form 910.

2011 Mtc Uniform Sales Use Tax Certificate Multijurisdiction Fill Online Printable Fillable Blank Pdffiller

Uniformity Committee Memo Multistate Tax Commission

Multistate Tax Commission Audit Program

How To Use Multistate Tax Commission Mtc Forms Exemptax Youtube

Draft Model Uniform Statute On Multistate Tax Commission

.jpg.aspx)

Multistate Tax Commission News

Materials Multistate Tax Commission

Uniform Sales And Use Tax Exemption Certificates Accuratetax Com